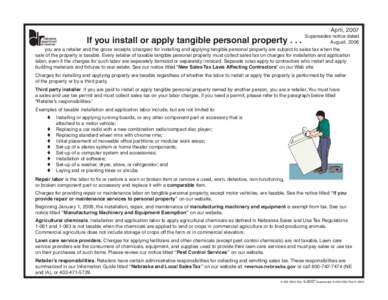

51 | Add to Reading ListSource URL: www.revenue.nebraska.govLanguage: English - Date: 2015-11-17 14:28:40

|

|---|

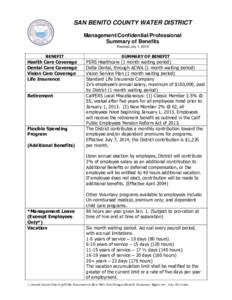

52 | Add to Reading ListSource URL: www.sbcwd.comLanguage: English - Date: 2014-10-21 13:58:49

|

|---|

53 | Add to Reading ListSource URL: fmc.comLanguage: English - Date: 2016-01-11 11:53:07

|

|---|

54 | Add to Reading ListSource URL: cityofbardstown.orgLanguage: English - Date: 2016-08-23 13:14:32

|

|---|

55 | Add to Reading ListSource URL: www.pensionsage.comLanguage: English - Date: 2016-07-25 05:44:42

|

|---|

56 | Add to Reading ListSource URL: www.nagdca.orgLanguage: English - Date: 2014-05-20 15:03:24

|

|---|

57 | Add to Reading ListSource URL: www.aist.asn.auLanguage: English - Date: 2015-08-30 22:18:54

|

|---|

58 | Add to Reading ListSource URL: riseupms.comLanguage: English - Date: 2016-05-10 14:19:53

|

|---|

59 | Add to Reading ListSource URL: www.homepages.ucl.ac.ukLanguage: English - Date: 2012-03-20 13:20:06

|

|---|

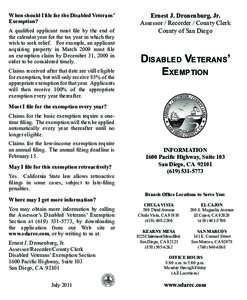

60 | Add to Reading ListSource URL: arcc.sdcounty.ca.govLanguage: English - Date: 2013-04-05 14:48:09

|

|---|